xiaohongshu

I think it’s because a lot more criminals use Telegram than other platforms like Facebook.

It’s because of Putin. You have to work harder, sacrifice more all because Putin is trying to invade Europe. Without Putin, you wouldn’t have had to go through this. Blame Putin, not us.

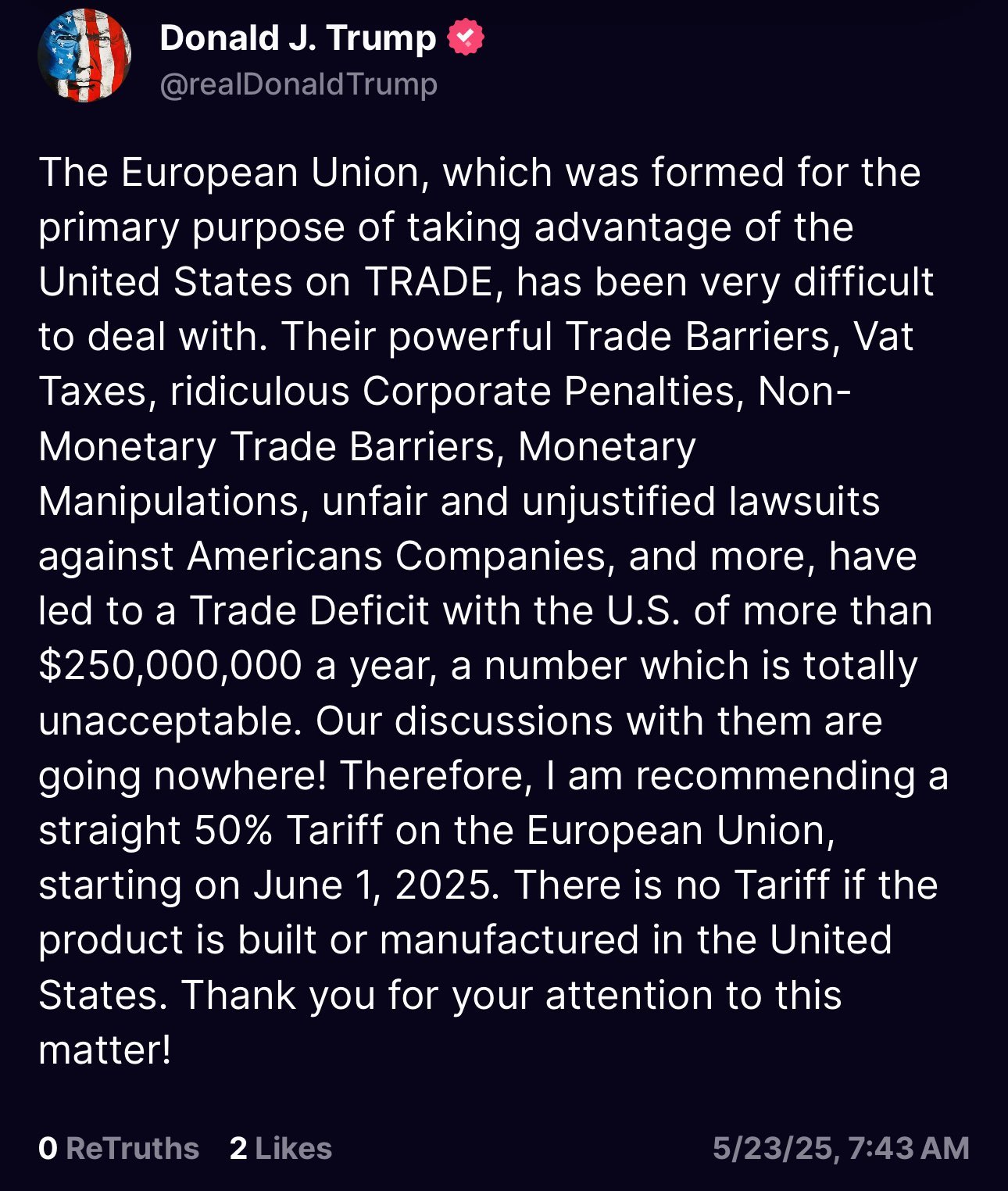

250,000,000 is a BIG number!

I have said it before and I will say it again: Trump’s assault on public institutions will end with a public backlash against federalism in America. It is going to pre-emptively kill off any kind of nationalization narrative that the left has been attempting to make a case for.

It is a spectacle. It is priming the people for the eventual “mainstream” narrative that says “oh, you want your kids’ educations to be funded by the government? Look, what if just one person, you know, like Donald Trump, just like Mao in communist China, who doesn’t like your politics, who hates DEI, and decides to defund our academic institutions with world class reputation built over an entire century?”

“Trump’s reckless use of his executive power shows us exactly why the FREE MARKET, not nationalization, is the superior system. Under the free market, you will find always be able to find private investors who are fine with your IDEOLOGY, who cares about FREEDOM OF SPEECH, and therefore willing to finance your business. A true marketplace of ideas. It is exactly the opposite of Trumpian authoritarianism that Trump is attempting to emulate from the oppressive Chinese regime.”

The bourgeoisie are fully behind this.

Point taken. The US can, in fact, default on its bonds as a political choice, and it would take Congress to do it.

On the flip side, it’s not a bad thing that the US stops selling treasuries (anything beyond a 3-month bills)? Why give out free money to rich people?

Nothing bad can happen if the US just stops selling treasuries (it doesn’t need to borrow to spend) - just a lot of domestic and foreign investors losing their money and won’t buy dollar-denominated treasuries ever again, but then there is no need for a government running a floating exchange rate to do that (just let the interest rate fall to 0%). It’s a regressive system inherited from the gold standard era where your currency is pegged to a metal/some other currency.

It’s just standard operations.

If foreign central banks don’t want to buy US treasuries, or have sold off their holdings of US treasuries, then they will simply spend the money elsewhere (e.g. purchase other dollar-denominated securities, in which case, somebody else gets the money and have to choose to spend it elsewhere, or to save in US treasuries).

If they choose to keep the money in a (US) bank, then the bank will simply use the reserves to buy US treasuries. In this case, instead of foreign central banks earning interests, it is a US bank that earns the interests lol.

Reserves are simply money that only banks have special access to in the central bank (in the US, this is the Federal Reserve). Its goal is to clear payments.

Let me give you a simplified example: say I transfer $1000 to your account (because I bought something from you), how does that $1000 disappear from my bank account and reappear in your bank account (assume in another bank)?

This is where reserves come in: my bank will debit $1000 from my account, and its reserves also simultaneously drop by $1000 (special account in the Fed). Your bank will then have an increase in $1000 in reserves, and a corresponding $1000 is credited into your bank account.

This is what allows millions and millions of bank transactions and payments to clear every single day, all around the world!

If you choose to withdraw this $1000 to buy US treasury bonds (effectively a savings account), then your bank account will drop by $1000, your bank’s reserve will also drop by $1000. In exchange, you get a bond certificate valued at $1000 with a certain % of interest until maturity.

Alternatively, if you choose to keep the $1000 sitting in your bank account, then your bank will simply take its $1000 in its reserve account in the Fed to buy US treasury bond. In this case, the bank will be the one earning interests, not you.

Remember, the national debt is simply the total amount of dollars the US federal government has spent that has not been taxed back yet. It is simply an accounting problem. No matter how you look at it, the amount of national debt will always equate to total US government deficits that haven’t been taxed back.

So all this talk about “stealth QE” is simply a misunderstanding of how central banking operations work. If bond investors don’t want to buy US treasuries, then what simply happens is they lose out on earning free money from the government. And if nobody wants to buy it (nobody wants free money), the Fed simply buys it through QE, which means nobody gets free money. The risk of US government defaulting on its bonds is exactly zero.

The Bank of England wrote a very nice explanation (complete with illustrations) on how such banking operations work, dispelling many of the myths often repeated about governments borrowing to spend.

How long before the US is going to use AI to run its economy?

I feel like this is now a very distinct possibility and will certainly have a disastrous outcome. Maybe the empire is really going to collapse under its own weight by chasing the AI crap lol.

How is saying that China should raise its wages so that the Chinese working class has the purchasing power to import from other Global South countries, a “chauvinist” position?

This is going to cause the Chinese manufacturing industries to be redistributed to the Global South. At the same time, living standards in China and the countries they import from will improve because of increased wages. How is that a bad thing?

Alternatively, a Chinese-style Marshall Plan that floods the Global South with yuan, which gives people from the other Global South countries the purchasing power to purchase Chinese goods, and this will in turn raise the wages of the Chinese working class, raising their own purchasing power, and this back and forth will lead to a more balanced and equitable development between countries.

This is way better than China investing in some poor countries to extract their minerals and resources to fuel their own manufacturing sector at home, and in effect, just another form of colonization. What I am proposing is actually going help develop and industrialize the other poor countries, like what the US did to post-war Germany through Marshall Plan.

Currently, China wants to have its cake and eat it too. They want to be the global export superpower (which squeezes the wages of the other Global South countries because they simply do not have the production of scale to match China’s) and at the same time they don’t want other countries to save in yuan, because they want other countries to import Chinese goods, not to save in its currency. This is leading to the exporting countries competing with one another, and why they all still depend on the US to become the “buyer of the last resort”, because there is nowhere else for the surplus goods to go. How is that “chauvinist”?

The reason I brought up the EU is because the euro is still a far more acceptable currency for most countries to save in (see the figure in my previous comment) than yuan (how many Global South countries do you think would prefer to hold euro than Chinese yuan? The vast majority of them!), and quite frankly, the real concern for the US imperialists if the dollar is ever going to be challenged. I seriously think that the US has calculated that China is never going to weaponize its yuan, and so far they have been proven right.

Just remember to take everything I say with a huge grain of salt lol.

This is going to come across as a bit of incoherent rambling, but let me try:

Honestly, I think the take that “China already has a strong economic base and financial system to challenge US hegemony” is far more optimistic than what I’ve commonly heard in Western leftist spaces like “nooo China still needs MORE primitive accumulation of capital to become socialist!” and “China is playing the long game and this liberal policy is actually a WIN for BRICS”.

Like, my friend, China already has a global manufacturing share of 31% (compared to 18% in the US, and 5% each for Germany and Japan). If this is still not enough, then our entire socialist project is doomed. How else are other countries ever going to achieve socialism?

I’m also not going to sugar coat it: China’s economy is the only one that can directly challenge and realistically replace the US, at least in short-intermediate term. It is a policy choice. The key challenge is how to get the world to accept the yuan, and to get the local bourgeoisie who have accumulated trillions of dollars over the past decades to give up their huge privilege.

And just to dispel the idea that my analysis is frequently “China centric”, I’ll remind everyone that this source of optimism that we have for the past few years was only because of Russia’s valiant defiance against the entire Western-dominated economic and financial system. People often under-appreciate what Putin had done that, while the Ukraine war was provoked and caused mass casualties, its defiance to unprecedented global sanctions forced the US to take a high risk gambling approach to protect the hegemony of the dollar.

You’ll often see me praising Putin for canceling $23 billion of Africa’s debt, because that’s absolutely the right thing to do, if only China had followed up with its trillions of dollar reserves - it can achieve a lot for the Global South just by making the big numbers of its bank statement to go down. And Russia indeed had rallied many Global South countries to its call for de-dollarization (anyone remembers the summer of 2022? It was nice, albeit a bit naive in retrospect) Unfortunately Russia’s economy was simply too weak to take on the global hegemon, and China’s eventual doubling down for preserving the dollar hegemony sealed the fate of this unprecedented opening never seen in decades.

I will also give it that Putin’s willingness to let the world sanctioning its oligarchs is far more of a baller move than China has ever done in recent years. Too bad, when your economy is weak, and doesn’t help with the liberal economists continuing to sabotage from within, there is only so much energy you can exert on a global scale - exactly what I have said about most countries simply being too weak to take on the global hegemon.

On the flip side, I often wonder how much longer can China keep going with the charade? No, this is not the right wing’s “China’s going to collapse because of COMMUNISM” lol. While the US economy itself seems teetering on an impending crisis, my pessimism is more a reflection of what many people around me have felt in recent months: the initial surge (often fueled by nationalistic propaganda) of “China is defeating Western countries in handling Covid!” in 2020 had gradually turned into “the economy’s gonna recover after Zero Covid, we just need to give it some time” in 2023 to the more pessimistic “welp, the recovery that was promised isn’t happening, I’m gonna be careful with how I spend with so much uncertainty in the world” last year. With the uncertainty of getting laid off at any point, people chose to save instead, because a lack of welfare means that people fear their current level of income, once lost, cannot be easily replenished.

The plunging property market (it’s cooked) and the deflationary spiral despite multiple rounds of subsidies have fueled a lot of disappointment, if not resentment. For many people, it’s almost as if the government will do anything just to avoid raising the wages of the people. Lots of big charts showing the economic recovery, but people continue to feel their wallets getting lighter (reminds me of the Bidenomics propaganda in the US not too long ago).

Meanwhile, the two key economists who pushed for the whole property market investment scheme for the past decade, Justin Lin Yifu and Meng Xiaosong, continued to be revered by the leadership, doubling down on rhetoric like “we need to double down on more investments to raise the wages of the people so they can consume”, when one should be asking: “how is producing even more goods going to raise wages when nobody has the money to buy them?”

It doesn’t help that for those paying attention to left politics, Xi’s ten years of reining in private capital and cracking down neoliberalism have ended in complete reversal over the span of the past few months, with Xi now doubling down on affirming the “sanctity” of private capital (that the COMMUNIST Party of China will DEFEND lol) and disgraced capitalists like Jack Ma have now returned to the altar.

There has been a lot of nationalistic propaganda about how China’s consumption has recovered “look at the record turnout to watch Ne Zha 2” lol and “wow look so many people traveling on May Day holiday, who says China has a consumption problem?” as if people aren’t frontloading their vacations to take advantage of promoted subsidies. But, how long can these “feel good” propaganda last?

There is now a lot of technocratic push to promote a technological revolution like EVs (the price wars are decimating hundreds of companies and suppliers), solar panels (the industry registered one of the worst losses last year) and AI and robotics, hoping that a technological revolutiom is going to bring forth an economic transformation, magically propeling the country to a high income country. Too much emphasis on STEM (too much worshipping Elon Musk) and too few attention paid to social policies and reforms. Anything to avoid giving people money and welfare.

So, how long before people are going to endure before they have had enough? How long can the liberals continue to sell their snake oil economics before the central leadership (which unfortunately is full of them right now) decides that they can no longer be trusted? Furthermore, how long before the central government rein in on the outsized authorities of the local governments (a sequelae of decentralization since the post-Mao reform), that have continued to cause troubles at the national level?

No, I’m not saying that China’s economy is going to collapse lol, that’s never going to happen. But if you had asked me if China is treading the path of Japan, even just two years ago, I would have thought ridiculous. Now, I’m not so sure anymore.

Sorry for the long rant. I hope it gives you some perspective from my end.