Been unable to afford a house since I first tried avocado toast circa 2008

News

Welcome to the News community!

Rules:

1. Be civil

Attack the argument, not the person. No racism/sexism/bigotry. Good faith argumentation only. This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban. Do not respond to rule-breaking content; report it and move on.

2. All posts should contain a source (url) that is as reliable and unbiased as possible and must only contain one link.

Obvious right or left wing sources will be removed at the mods discretion. Supporting links can be added in comments or posted seperately but not to the post body.

3. No bots, spam or self-promotion.

Only approved bots, which follow the guidelines for bots set by the instance, are allowed.

4. Post titles should be the same as the article used as source.

Posts which titles don’t match the source won’t be removed, but the autoMod will notify you, and if your title misrepresents the original article, the post will be deleted. If the site changed their headline, the bot might still contact you, just ignore it, we won’t delete your post.

5. Only recent news is allowed.

Posts must be news from the most recent 30 days.

6. All posts must be news articles.

No opinion pieces, Listicles, editorials or celebrity gossip is allowed. All posts will be judged on a case-by-case basis.

7. No duplicate posts.

If a source you used was already posted by someone else, the autoMod will leave a message. Please remove your post if the autoMod is correct. If the post that matches your post is very old, we refer you to rule 5.

8. Misinformation is prohibited.

Misinformation / propaganda is strictly prohibited. Any comment or post containing or linking to misinformation will be removed. If you feel that your post has been removed in error, credible sources must be provided.

9. No link shorteners.

The auto mod will contact you if a link shortener is detected, please delete your post if they are right.

10. Don't copy entire article in your post body

For copyright reasons, you are not allowed to copy an entire article into your post body. This is an instance wide rule, that is strictly enforced in this community.

It must be because of those dang woke DEI!

Wages didn't increase at the rate of inflation for like 80 years. The USA is now a shithole country in general and emigration out has reached all time highs, kids don't want to buy homes here. All of the overseas investors looking to purchase US properties no longer trust in the USA due to volatility due to an actual dictatorship forming and heavy fines and tariffs being put in place by countries on either side of the issue.

I could go on.

Article title writer pictured here

My household income is well above the median in my area. Besides a bit of student loans, I have no other debt. I'm doing pretty well compared to most people my age, financially.

I still needed an FHA and down payment assistance to squeak into the cheapest house on the market that wasn't a trailer

They will never acknowledge it unless they are made to

Because those who make the rules don't want you to own shit.

Because the common citizens will have more problems than buying a house after the Orange Goblin and his fellow criminals started to irrevocably dismantle the nation forever? 🤔

I know no one really asked this question.

- Average house price in Q1 2025 was $500,000.

- $100k down at 6.5% with great credit and monthly payments of $3180 for 30yrs.

How many people can say they will have a job that pays that well for 30 yrs?

Unless you live near a major city. Then you double the price of housing.

$100k down

Fucking LMAO

"Yeah, before you buy, we want an amount of money you will never have at any one point in your entire life before we consider thinking about suggesting a mortgage to you"

Oh....you poor bastard. Now you can pay the PMI and your morrgage will be around $4400 a month. You can save up $15-20k and refi when rates go down.

Welcome to renting for ever.

WE ARE ALL FUCKING POOR

Probably the same reason megacorporatins are turning in record profit, year over year, and a very few people have increased their income by several billions of dollars, but that's just a guess. 💁

Don't forget about the corporations that are buying as many houses a quick as possible (faster than a person who will have a mortgage can) and at a higher price than what a person can/will pay becaue they are using them as investments.

Absolutely!

People aren't paid enough. The rich have too large a portion of the resources.

Eat the rich. Bury their collaborators.

Bury them where? I can't afford a plot of land :(

The worst part is that I am getting paid a salary I could have only dreamed about years ago, and yet I still can't afford anything with how drastically everything went up in price.

Wages in general have gone up a little bit, but it's crazy to me that I'm earning more than 5x as much as I used to 15 years ago and feel like my buying power has not noticeably improved at all. I'm still stuck living in crappy apartments because that is all I can afford.

Exactly! My partner and I together make over $100,000 a year and finally we are just barely comfortable. All of our bills get paid and even though the budget is tight, we still have a little money and decent credit. I could put a $1,000 guitar on credit and pay that off no problem, but there's no way we could get a house.

Maybe if our wages doubled then we could find something further out in the sticks. Hopefully by that time more companies allow full remote work because I already lose an hour or more a day traveling.

House expensive and job no pay enough.

oh we know why, it’s not a mystery to anyone who talks to the average american worker. we are criminally underpaid for our labor and it gets worse the younger the generation is. millennials are more poor than their parents’ generation, and gen z will likely end up poorer than millennials.

A house is a huge liability. If i lose my job, what do i do about the debt? It's the job market uncertainty that i fear more than the current pay levels, tbh.

House is an asset. Mortgage is a liability. Having one without the other is now a dream.

Homes are fucking expensive. I couldn't afford to buy a house in most markets at current prices. I have no idea how people are able to buy homes today.

Even my neighbor down the street...1st home for him, wife, and 2 year old kid. He tried to sell because he didn't understand how property taxes worked. The previous owner of 30 years payed 1.5K a year. He bought the home and was hit with a 15K tax bill. He couldn't afford it and thought his bill would also be 1.5K. The closing agent and real estate agent didn't explain anything to him. They were just happy to collect commission and fees on a very expensive house.

This doesn't make sense to me.

In my state the bank pays the property taxes. Its included in the monthly mortgage and goes into an escrow account for taxes.

I guess the rules vary by state.

Some places cap property tax increases per year, or even have a flat rate based on purchase price (or appraisal?) that never goes up… until you sell the house to someone new. Then the tax gets recalculated based on the current value of the house. So if the price of the house went up 10x in those 30 years, the tax is going to be 10x higher. It’s actually beneficial to the taxpayer IMO to have a consistent predictable tax that doesn’t go up over time if your neighborhood gets gentrified or whatever and home prices skyrocket.

Ah, a Californian

Because the only part of the economy doing well is home values

capitalism. there. article done.

I fucking wonder. Maybe I can ask Grok.

Grok: "It's the Joos. Heil Hitler!"

So, after last week, I guess that’s heil Grok?

...Grokler?

Mecha Grokler

I'd wager that Elno changes Grok's name to something similar in the coming months.

A 7% interest rate doesn’t help

We bought in 2020 and have a 2.875% rate on our mortgage. We only put 10% down and had PMI but the broker was all, "you can refinance to get rid of that".

I asked him when in the world we'd ever be able to refinance at or below that rate? He had nothing to say to that.

Just FYI there are stipulations to removing PMI from a mortgage but refinancing usually isn’t one of them. Each situation is unique though. FHA and VA loans are different, etc.

You are incorrect.

As the house value increases with the market you can refinance to a new lender with greater equity eliminating the need for PMI.

Not on top of the wild overvaluation.

I had two houses at that interest rate in the 2000’s. The wage to house price was still reasonable then. Made $40k, paid $88k for a 3/2 in middle class suburban Tampa. I’m making 30% more now but houses are 400% more.

While true, I would point out that the low mortgage rates that increased housing prices

low mortgage rates permit people to borrow more and tends to drive up prices

in the decade-and-a-half before 2022 was unusual for the US. Prior to about 2008, interest rates were at or higher than they are today.

Here's a graph of the 30-year fixed-rate mortgage rate:

https://fred.stlouisfed.org/series/MORTGAGE30US

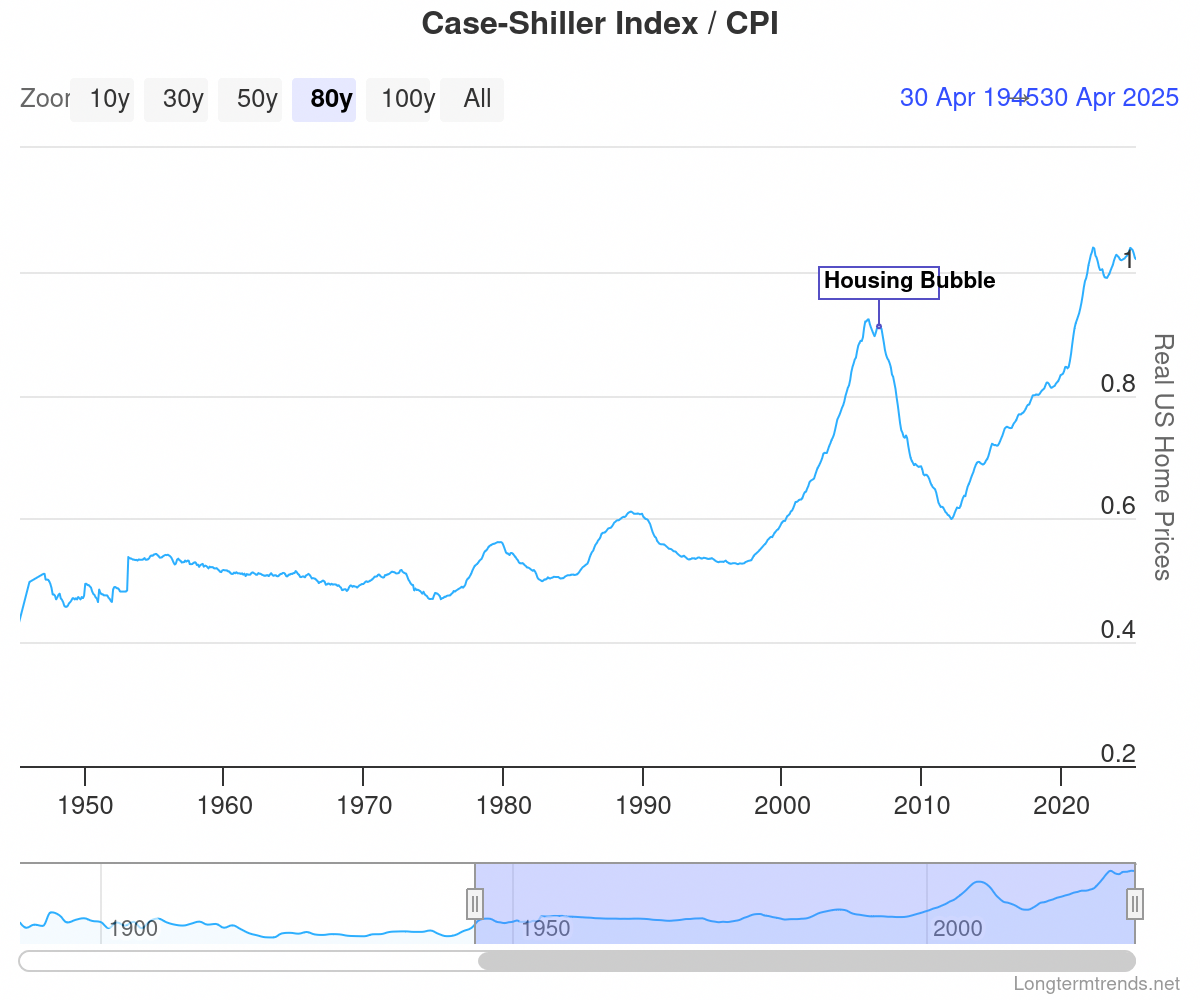

Here's the Case-Shiller Home Price Index. This measures same-home prices

that it, it attempts to factor out changes in types of home being built, so new homes being larger won't drive it up.

https://fred.stlouisfed.org/series/CSUSHPISA

It's not adjusted for inflation, though.

Here's an inflation-adjusted graph:

https://www.longtermtrends.net/home-price-vs-inflation/

Between about 2011 and 2022, the real price of a given house rose rapidly in a low mortgage rate environment. In 2022, mortgage rates returned to something that's more historically-normal.

I expect that to sell a house in this environment, a homeowner will probably have to cut what they're asking.

Now combine them both and do average monthly payment.

Even with higher prices, lower interest rates mean lower monthly costs

$$$$?!?

Because of the increasing gap between wages and property values?

Because home ownership is increasingly becoming a trap? Gee, lemme save up a high 5 digit sum of money over the course of a decade so i can afford to BUY IN to a ridiculous sum of debt that, even if its paid off eventually, will be taken away to cover medical debt in old age! All to prop up infinite growth in property values to prop up a stock market.

wattt